Top Headlines

Sector News

Mexico’s economic outlook dims after weak finish to 2018

Mexico’s economy grew less than first estimated in the fourth quarter as activity contracted in December, the first month of President Andres Manuel Lopez Obrador’s administration, data showed on Monday, clouding the outlook for 2019.

Source →US economy to enter a recession by 2021, economists predict

The U.S. economy might appear to be humming along in the late stages of an economic expansion, but experts don’t think it will be sustained for too many years to come.

Source →Housing Starts Decline to Two-Year Low in December

U.S. new-home construction in December fell to the lowest since September 2016, as builders held back during a turbulent month for financial markets. Residential starts fell 11.2% to a 1.08 million annualized rate after a downwardly revised 1.21 million pace in the prior month, according to government figures Feb. 26 that missed all forecasts.

Source →Ports of Los Angeles and Long Beach post strong volumes to start 2019

While uncertainty regarding the direction of the United States and China trade talks lingers, January volumes recently issued by the Port of Los Angeles (POLA) and the Port of Long Beach (POLB) were both very strong. Total POLA January volumes, at 852,440 TEU (Twenty-Foot Equivalent Units) marked a 5.4% annual gain and represent the busiest January output for the port in its 112 years of operation, while also marking the seventh consecutive month of POLA monthly volumes topping the 800,000 TEU mark.

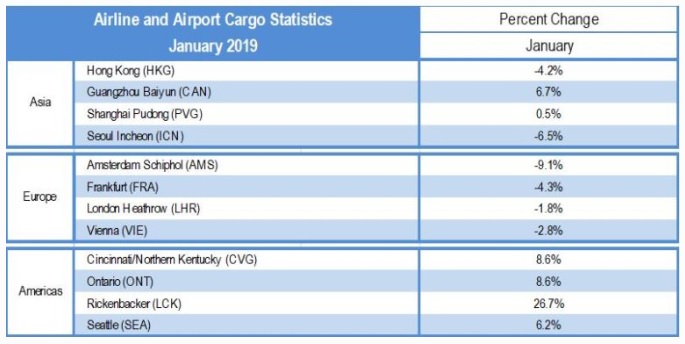

Source →Shifting economic conditions, mixed results in January airport throughput

Cargo throughput results for the beginning of 2019 were mixed, with certain regions performing significantly better than others. Airports in North America saw the majority of growth in cargo volumes in January, while airports in Mainland China saw modest rebounds and European airports experienced a continued decline in cargo volumes following an overall diminished 2018 peak season.

Source →Growing Forth Worth logistics hub among BNSF’s capital spending plans for 2019

BNSF, a unit of Berkshire Hathaway (NYSE: BRK.A), plans to add rail capacity at its Alliance Intermodal Facility as distribution and warehousing space in the Fort Worth market is anticipated to grow substantially. As part of its previously announced capital spending plans, the largest U.S. railroad said it plans to spend $405 million in Texas this year, compared to $375 million spent in 2018. BNSF said over half of the 2019 funds will go to increasing capacity and train speeds in the state.

Source →Rail Traffic for the Week Ending February 23, 2019

The Association of American Railroads (AAR) today reported U.S. rail traffic for the week ending February 23, 2019. For this week, total U.S. weekly rail traffic was 522,630 carloads and intermodal units, down 1.1 percent compared with the same week last year. Total carloads for the week ending February 23 were 256,954 carloads, up 2 percent compared with the same week in 2018, while U.S. weekly intermodal volume was 265,676 containers and trailers, down 3.9 percent compared to 2018.

Source →UPS Freight announces 2019 general rate increase

Earlier this month, UPS Freight, the less-than-truckload subsidiary of Atlanta-based transportation and logistics bellwether UPS announced general rate increases (GRI) that went into effect on February 18. The GRI, which applies to non-contractual less-than-truckload (LTL) shipments rated on the current UPS Freight 525, 560, 570 and 571 tariffs, is 5.9%.

Source →FMCSA Administrator: Please Prepare Now for ELD Deadline

Ray Martinez, administrator of the Federal Motor Carrier Safety Administration, asked attendees at Omnitracs’s user conference to “please prepare” for the December transition from AOBRDs to ELDs “now, if you have not done so.” Speaking at the conference’s opening session, Martinez noted that 2019 is a critical year for ELD implementation and that putting it off does not help either the industry or the regulators .

Source →Climbing US truck registrations bolster capacity

The number of new trucks hitting the road in the United States is likely to increase in the first half of 2019, bolstering available capacity, according to an analysis of data from IHS Markit, the parent company of JOC.com. However, those numbers may level off later in the year.

Source →Auto industry lines up against possible U.S. tariffs

The U.S. auto industry urged President Donald Trump’s administration on Monday not to saddle imported cars and auto parts with steep tariffs, after the U.S. Commerce Department sent a confidential report to the White House late on Sunday with its recommendations for how to proceed.

Source →US Container Imports Still Strong as Tariff Increase Approaches

Imports at the nation’s major retail container ports have dipped since peaks seen last fall but remain at higher-than-usual levels as a possible increase in tariffs on goods from China approaches in March, the National Retail Federation (NRF) and Hackett Associates said.

Source →Transpacific airfreight rates decline again in January

Airfreight rates on the transpacific trade lane continued to come under pressure in January as contacts say that demand at the start of 2019 has been lacklustre. Figures from Tac Index show that airfreight rates on services from Hong Kong to North America declined by 0.8% year on year to an average of $3.66 per kg.

Source →Railroads look to PTC to shake out more capacity

For the last 10 years, freight railroads and their regulators have emphasized the safety benefits of Positive Train Control (PTC). But with the technology getting closer to being up and running on every freight track mile required by federal mandate, the nation’s big railroads are starting to consider how PTC may help them make better use of their assets.

Source →FRA report: All railroads met statutory PTC requirements by 2018’s end

The Federal Railroad Administration (FRA) late last week released a status update regarding railroads’ self-reported progress toward implementing positive train control (PTC) by 2018’s end. All 41 railroads either met the end-of-2018 statutory deadline for full implementation or submitted requests for an extension up to two additional years by demonstrating they met or exceeded certain criteria for an alternative schedule, such as by installing all wayside systems and training all employees, the status report shows.

Source →Rail Traffic for the Week Ending February 16, 2019

The Association of American Railroads (AAR) today reported U.S. rail traffic for the week ending February 16, 2019. For this week, total U.S. weekly rail traffic was 523,915 carloads and intermodal units, down 3 percent compared with the same week last year. Total carloads for the week ending February 16 were 250,236 carloads, down 3.9 percent compared with the same week in 2018, while U.S. weekly intermodal volume was 273,679 containers and trailers, down 2.1 percent compared to 2018.

Source →New Jersey has the Worst Traffic Bottleneck in the Country

For the first time since 2014, New Jersey has topped the American Transportation Research Institute’s annual list of the most congested bottlenecks for trucks in the country.

Source →FTR’s Trucking Conditions Index sees significant gain

For December, the most recent month for which data is available, the TCI came in at 11.46, a significant increase over November’s 5.84 and October’s 3.17. FTR said strong sequential volume gains, as well as a favorable fuel environment paced this growth.

Source →NRF says ‘state of the economy is sound’ and forecasts retail sales will grow between 3.8 and 4.4 percent

The National Retail Federation today forecast that retail sales during 2019 will increase between 3.8 percent and 4.4 percent to more than $3.8 trillion despite threats from an ongoing trade war, the volatile stock market and the effects of the government shutdown.

Source →Want To Forecast The U.S. Economy In 2019? Watch These Three Indicators

The turbulence in the stock market during the last month of the year has led many to forget that the overall state of the economy was positive in 2018, as it performed well by most measures, including year-over-year growth and a strong labor market.

Source →Ocean Carrier Trends: Containing capacity while remaining poised for growth

Coinciding with the upswing in the world economy two years ago, global seaborne trade is doing well, note analysts for the Geneva-based United Nations Conference on Trade and Development (UNCTAD). They also observe that containerized shipping expanded by 4% in 2018-the fastest growth in five years.

Source →IATA reports passenger and freight growth in 2018

The International Air Transport Association (IATA) announced global passenger traffic results for 2018 showing that demand (revenue passenger kilometres or RPKs) rose by a healthy 6.5%, whilst air freight grew by 3.5% (both compared to full-year 2017).

Source →Class I’s continue to gain traffic boost from logistics units

Class I’s grew their carloads and intermodal loads in 2018 on a year-over-year basis. Their traffic-building efforts helped U.S. intermodal volume set an annual record for the fifth time in the past six years. The large roads marked a key volume assist from their logistics services, which run the gamut from transloading to warehousing to freight forwarding. Each Class I operates a logistics subsidiary or ancillary services unit, or is affiliated with a logistics service provider.

Source →Washington update 2019: What will a new and divided Congress mean for rail?

Passing a permanent extension of the 45G short-line tax credit. Maintaining existing truck size and weight restrictions. Introducing a comprehensive infrastructure package that includes funding priority for freight and passenger rail. Shoring up the federal Highway Trust Fund. Continuing existing “balanced” regulations for freight railroads.

Source →Challenges to US urban supply chains mount

“Relentless competition” and widespread urbanization are two of the top trends that will reshape trucking and logistics in the US and elsewhere as e-commerce expectations set by Amazon and its customers challenge traditional delivery strategies and processes, speakers at the SMC3Jumpstart 2019 Conference in Atlanta said Jan. 28-30.

(This article requires a subscription to the Journal of Commerce. To subscribe, please click on the above link.)

Rail Traffic for the Week Ending February 9, 2019

The Association of American Railroads (AAR) today reported U.S. rail traffic for the week ending February 9, 2019. For this week, total U.S. weekly rail traffic was 519,779 carloads and intermodal units, up 0.1 percent compared with the same week last year. Total carloads for the week ending February 9 were 242,266 carloads, down 3.3 percent compared with the same week in 2018, while U.S. weekly intermodal volume was 277,513 containers and trailers, up 3.4 percent compared to 2018.

Source →FMCSA Grants One HOS Exemption, Receives Request for Another

The Federal Motor Carrier Safety Administration has granted reprieve from hours-of-service rules to one group and received an exemption request from the rules from another.

Source →No “crash” ahead after US truck capacity crunch

Nearly seven weeks into 2019, the contour of the US trucking landscape is becoming somewhat clearer. Truck capacity generally should be less tight this year than in 2018, but shippers shouldn’t expect another 2016, when excess capacity was the rule, rather than the exception. (This article requires a subscription to the Journal of Commerce. To subscribe, please click on the above link.)

Source →Oil Slips as Service Slowdown Adds to Warning Signs on Economy

Oil sank for a second straight day as service-sector orders fed worries about the economy and traders received another report of booming U.S. crude supplies.

Source →The US-China trade war could benefit Europe, Mexico and Japan

The trade war between the United States and China has caused major disruptions for global businesses – but it may also bring benefits for some. Companies in Europe, Mexico, Japan and Canada could add tens of billions of dollars in export orders if the conflict drags on, according to a study released this week by the United Nations Conference on Trade and Development.

Source →Consumer spending on track for worst year in decade, says National Bank

A slowing Canadian economy will result in consumer spending falling to its lowest level in a decade this year, according to a new report from the National Bank of Canada. Economists at the bank expect real consumption growth – which is calculated once the impact of inflation is stripped out – to hit 1.3 per cent in 2019, which would be the lowest since 2009 when it fell to 0.2 per cent amid the global financial crisis.

Source →January non-manufacturing output sees mild dip but remains on right side of growth, says ISM

The Institute for Supply Management (ISM)reported today its Non-Manufacturing Report on Business that non-manufacturing activity grew to start 2019, albeit at a slightly slower level than it did to close 2018.

Source →US truckers, shippers: ‘How slow can we grow?’

Last year, the big question about the US economy was, “How fast will it grow?” Now, everyone’s asking, “How fast will it slow?” Euphoria has given way to worry and concern amid trade disputes, stock market volatility, and a partial government shutdown. Economists who spoke at the SMC3 Jump Start 2019 conference this week don’t expect a recession in 2019, but slower growth may feel like decline after the strong growth of 2018.

Source →NY/NJ Port Reaches 7 Mn TEU Milestone

The Port of New York and New Jersey witnessed a record-breaking year as it handled over 7 million TEU in 2018 for the first time in its history.

Source →Trump calls for “great rebuilding” of infrastructure

Among myriad goals and accomplishments outlined in his State of the Union address Tuesday night, President Trump asked Capitol Hill lawmakers to “unite for a great rebuilding of America’s crumbling infrastructure.”

Source →Rail Traffic for the Week Ending February 2, 2019

The Association of American Railroads (AAR) today reported U.S. rail traffic for the week ending February 2, 2019, as well as volumes for January 2019. U.S. railroads originated 1,238,487 carloads in January 2019, up 1.7 percent, or 21,054 carloads, from January 2018. U.S. railroads also originated 1,316,168 containers and trailers in January 2019, up 0.5 percent, or 6,008 units, from the same month last year. Combined U.S. carload and intermodal originations in January 2019 were 2,554,655, up 1.1 percent, or 27,062 carloads and intermodal units from January 2018.

Source →State of Global Logistics: Time for a reality check

A combination of rising global interest rates and ongoing trade protectionism will continue to create unexpected turbulence for logistics managers over the course of 2019, say analysts. Meanwhile emerging markets will provide opportunities for faster growth-yet each faces its own set of operational challenges.

Source →How is the Growth of E-Commerce Affecting Trucking?

Some of the issues of most concern to the industry, such as the driver shortage, hours of service, and truck parking, are affected by the growth of e-commerce and omni-channel marketing. The American Transportation Research Institute released an analysis of these impacts, including the challenges and opportunities posed by more regionalized retail supply chains and the proliferation of urban “last mile” deliveries have presented.

Source →Thanks to Trump, China’s economy is rapidly decelerating — Here’s what could happen next

President Trump is exposing China’s economic vulnerability, showing that the communist nation cannot maintain its rapid growth without it patently unfair mercantilist trade policies. The Chinese government recently announced that its GDP growth for 2018 of only 6.6 percent – the country’s slowest rate of economic development since 1990. Growth in the fourth quarter declined to 6.4 percent. For the second half of 2018, Chinese investment, consumer spending, manufacturing and exports all slowed markedly with the current trade war with the U.S. hurting China more than anticipated.

Source →Steve Forbes: Passing US/Mexico/Canada Deal would bring big benefits to our economy

After months of painstaking bargaining by President Trump’s negotiating team, the renegotiated North American Free Trade Agreement (NAFTA), now rebranded as the United States-Mexico-Canada Agreement (USMCA), looks to set a template for modern American

trade agreements in the 21st century. By all initial measures the USMCA lives up to frequently promised, but seldom delivered, concepts of free, fair and reciprocal trade.

Fed Chair Powell says economy will make back most of shutdown effect in the next quarter

Federal Reserve Chairman Jerome Powell said Wednesday afternoon that the American economy will recover most of the lost economic output lost during the federal government’s partial shutdown.

Source →Air Cargo Supply Chains to Remain Profitable for Carriers, Says IATA

The International Air Transport Association (IATA) forecasts the global airline industry net profit to be $35.5 billion in 2019, slightly ahead of the $32.3 billion expected net profit in 2018 (revised down from $33.8 billion forecast in June).

Source →Asian airlines report growth in 2019 despite end of year slowdown

Asian Pacific airlines recorded an “encouraging” increase in air cargo volumes in 2018, despite a slowdown towards the end of the year. The latest figures from the Association of Asia Pacific Airlines (AAPA) show that air cargo volumes increased by 3.9% year on year in 2018. However, growth continued to slow as the year progressed, in December, for example, the member airlines registered a 0.7% decrease compared with a year earlier.

Source →AAPA: $4 billion needed to protect ports, supply chain security

The American Association of Port Authorities (AAPA) has identified nearly $4 billion in “crucial” port and supply chain security needs over the next decade, according to a new report. In the fourth edition of its “The State of Freight” report, the AAPA recommends refocusing the Federal Emergency Management Agency’s Port Security Grant Program to “better meet the security infrastructure needs of publicly owned commercial seaports and related maritime operations,” AAPA officials said in a press release.

Source →Rail Traffic for the Week Ending January 26, 2019

The Association of American Railroads (AAR) today reported U.S. rail traffic for the week ending January 26, 2019. For this week, total U.S. weekly rail traffic was 522,026 carloads and intermodal units, down 4 percent compared with the same week last year. Total carloads for the week ending January 26 were 248,937 carloads, down 4.7 percent compared with the same week in 2018, while U.S. weekly intermodal volume was 273,089 containers and trailers, down 3.3 percent compared to 2018.

Source →Walmart Says It Needs 900 More Truckers This Year, Hikes Pay

Walmart is raising trucker salaries in its push to hire 900 more drivers this year across the United States, including Texas, where it has a big concentration of large distribution centers where empty trucks get filled.

Source →ATA Truck Tonnage Index Has Best Year in 20 Years

American Trucking Associations’ advanced seasonally adjusted For-Hire Truck Tonnage Index increased 6.6% in all of 2018 – the largest annual gain since 1998 and significantly better than the 3.8% increase in 2017.

Source →Faster supply chains creating US truck capacity

For US shippers struggling to secure truck capacity, now is the time to act, and the first thing they should think about is time, especially how much time is lost in their supply chains. Capacity most often is measured in drivers, tractors, trailers, containers – all physical assets, human or otherwise – and space, as in the amount of space available in a trailer or on a pallet. But the fourth dimension is capacity’s hidden dimension. Shippers facing concrete limits in physical capacity need to work with time to create capacity without adding assets.

Source →Canada’s economy may soon endure something it hasn’t faced in 68 years

Canada’s economy may soon endure something it hasn’t faced in 68 years: A recession without the U.S. in the same boat. That’s the view of Jim Mylonas, global macro strategist at BCA Research Inc. in Montreal, a firm that’s been making calls on markets and economies since 1949. Mylonas says the surge in household debt combined with rising interest rates will push the Canadian economy into recession, even while the U.S. economy continues to grow.

Source →China’s economy grew 6.6% in 2018, the lowest pace in 28 years

China on Monday announced that its official economic growth came in at 6.6 percent in 2018 – the slowest pace since 1990. That announcement was highly anticipated by many around the world amid Beijing’s ongoing trade dispute with the U.S., its largest trading partner.

Source →Jamie Dimon: US economy is like a ship that could hit a ‘slowdown or recession’

Another weekly decrease in diesel prices across the U.S. has fuel at its lowest price since 2017, according to the latest numbers from the Department of Energy. A 1.1-cent decrease during the week ending Jan. 21 has the U.S.’ average price for a gallon of on-highway diesel at $2.965. The last time prices were lower was Christmas Day 2017 when the national average was $2.903.

Source →High level of December U.S.-bound waterborne shipments finishes a strong 2018, says Panjiva

United States-bound waterborne shipments in December capped a record-breaking year for global trade, according to data issued this week by global trade intelligence firm Panjiva.

Source →Air cargo supply chain disruptions expected if U.S. shutdown persists

The current United States federal government shutdown is already the longest in history with no clear end in sight, and industry associations and participants are concerned that aviation and airfreight will suffer in the short- and long-term if it is not resolved soon.

Source →Challenges mount for US intermodal rail

As a new year for US transportation begins, the question of what’s to come inevitably comes to the fore. For intermodal, 2018 was a good year, the best in some time. But it also was a year of missed opportunities. Rather than a springboard for future gains, the industry’s performance may have created new challenges that will need to be overcome in the coming months. Meanwhile, big changes are underway in the underlying intermodal network and service offerings, with uncertain implications for the industry’s growth prospects.

Source →Rail Traffic for the Week Ending January 19, 2019

The Association of American Railroads (AAR) today reported U.S. rail traffic for the week ending January 19, 2019. For this week, total U.S. weekly rail traffic was 543,111 carloads and intermodal units, up 6.9 percent compared with the same week last year. Total carloads for the week ending January 19 were 258,833 carloads, up 7.4 percent compared with the same week in 2018, while U.S. weekly intermodal volume was 284,278 containers and trailers, up 6.5 percent compared to 2018.

Source →US regulators weigh truck HOS changes

As the era of the electronic logging device (ELD) enters its second year, US regulators are focusing their attention on the hours of service (HOS) those ELDs are designed to monitor. They are mulling proposed adjustments to the HOS rules and may be pressed by industry to go even further and consider broader changes to help give truck drivers greater control at the wheel.

Source →ATA Truck Tonnage Index Has Best Year in 20 Years

Truck tonnage closed out 2018 on a 20-year high with an annual increase of 6.6%, American Trucking Associations announced. The result was the highest for the federation’s seasonally adjusted for-hire truck tonnage index since 1998, when truck tonnage rose 10.1%, ATA said. And last year’s gain came despite a downturn in December, when tonnage dipped 4.3% to 111.9 from November’s level of 116.9. In calculating the monthly index, 100 represents 2015.

Source →Industrial outlook cloudy but solid overall economic fundamentals rosy for trucking industry

Mixed economic signals are proving to be somewhat of a Rorschach Test for shippers trying to gauge freight demand levels heading into the strongest part of the 2019 freight season.

Source →U.S. economy could slip from top spot in 2020 and keep slipping, analysts say

America’s days as the world’s most powerful economy are numbered, and when that torch is finally passed, it’ll be tough to get back, according to a recent report. In our call of the day, Standard Chartered predicts that China’s GDP will overtake the U.S. next year. What’s more, within another decade, India is pegged to push the U.S. even further down the list.

Source →US economy has good momentum in 2019: Fed Vice Chair Richard Clarida

The Federal Reserve Opens a New Window.affirmed its optimistic outlook for the U.S. economy Opens a New Window.in 2019. “The economy has good momentum going into 2019,” Federal Reserve Vice Chairman Richard Clarida said in an exclusive interview on FOX Business on Monday. “Our priority is pursuing a monetary policy that will achieve our objective, which is full employment and price stability.”

Source →NRF: US Container Imports to Weaken in First Half of 2019

Imports at the major retail container ports in the US have slowed down after a months-long rush to beat increased tariffs on goods from China, the National Retail Federation (NRF) said.

Source →Cargo demand in November a “big disappointment”, says IATA

The air cargo industry failed to register an increase in demand in November for the first time since March 2016 in what has been described as a big disappointment. The latest figures from airline association IATA show that cargo traffic was flat in November compared with a year earlier, following 31 consecutive months of year-on-year increases.

Source →Top 5 airfreight trends to expect for 2019

Every January brings with it anticipation of the months to come and what they hold for airfreight logistics. Trade wars, recent WorldACD reports and the impending finale of Brexit have instilled uncertainty into the market, but the outlook for this year still suggests growth.

Source →US intermodal growth to slow as tariffs pinch

US intermodal volume is set to grow for the third straight year but at a slower rate than 2018, thanks to international and domestic pressures. Tariffs on Chinese goods threaten the consumer confidence that drives the railing of containerized imports and US manufacturing. Trucking will also compete for domestic freight as spot market capacity is more abundant than it was a year ago, pressuring Class I railroad operators and intermodal market companies to be more competitive with price and service.

Source →Rail Traffic for December and the Week Ending January 12, 2019

The Association of American Railroads (AAR) today reported U.S. rail traffic for the week ending January 12, 2019. For this week, total U.S. weekly rail traffic was 555,127 carloads and intermodal units, up 8.4 percent compared with the same week last year. Total carloads for the week ending January 12 were 266,240 carloads, up 10.3 percent compared with the same week in 2018, while U.S. weekly intermodal volume was 288,887 containers and trailers, up 6.8 percent compared to 2018.

Source →Another trucking strike: Will it work this time?

Truckers Stand as One hopes to call attention to HOS reform, parking and other issues during a nationwide non-driving day in April.

Source →License delays bite into US truck capacity

Add another factor to the long list of contributing causes to the US truck driver shortages: Skills testing delays. Would-be drivers suffered a cumulative 6.4 million days of testing delays in 2016 alone, according to the Commercial Vehicle Training Association (CVTA). Those delays put 258,744 jobs on hold, at a cost of $1.4 billion to local economies, the CVTA said last week.

Source →Inflation pressure cools, but trucking rates keep climbing

Data on producer prices shows that overall inflation pressure calmed further in December, weighed down again by declines in energy prices. Industry detail showed that trucking rates continued to surge, however, driven by another large gain in long-distance trucking rates.

Source →Transportation Is the ‘Single Biggest Economic Opportunity in America Today’: Allstate CEO

Tom Wilson, CEO of Allstate, the insurance giant, believes an iconic element of the national character is doomed. “Americans’ love affair with the car is going to go away,” he told an audience of executives at Fortune’s Brainstorm Tech dinner on the sidelines of the Consumer Electronics Show in Las Vegas on Monday evening.

Source →U.S. Employers Added 312,000 Jobs in December, Despite Dismal Stock Performance

U.S. employers added the most workers since February last month and wages ticked up, providing a reassuring sign of economic strength amid concerns over stock market volatility, rising federal interest rates and a trade war with China. Non-farm payrolls grew by 312,000 jobs in December, according to numbers released Friday by the Labor Department.

Source →Diesel Average Drops 3.5¢ to $3.013 a Gallon

The U.S. average retail price of diesel dropped 3.5 cents to $3.013 a gallon, the U.S. Energy Information Administration reported Jan. 7, even as crude oil prices saw some renewed vigor and approached $50 per barrel.

Source →China Overtook the US as World’s Largest Crude Oil Importer in 2017

China surpassed the United States in annual gross crude oil imports in 2017, importing 8.4 million barrels per day (b/d) compared with 7.9 million b/d for the US, according to the US Energy Information Administration (EIA).

Source →Happy New Year: It’s not too early for ocean cargo shippers to plan for 2020

As we usher in 2019, many industry analysts are telling logistics managers to begin planning for a major transformational event coming into play for the ocean cargo sector a year from now.

Source →Retailers: Imports at major ports leveled off in late 2018

Imports at the nation’s major container ports slowed in November 2018 after a months-long rush to beat increased tariffs on goods from China, according to the National Retail Federation (NRF) and Hackett Associates.

Source →Air cargo and ocean carrier rates should make for sustainable supply chains, say analysts

Carrier pricing for air cargo shipments is also expected to remain on a steep trajectory, says Chuck Clowdis, managing director of the consultancy Trans-Logistics Group, Inc.

Source →Rail Traffic for December and the Week Ending January 5, 2019

The Association of American Railroads (AAR) today reported U.S. rail traffic for the week ending January 5, 2019. For this week, total U.S. weekly rail traffic was 436,103 carloads and intermodal units, up 4.8 percent compared with the same week last year. Total carloads for the week ending January 5 were 221,759 carloads, up 6.2 percent compared with the same week in 2018, while U.S. weekly intermodal volume was 214,344 containers and trailers, up 3.4 percent compared to 2018.

Source →Trucking Industry Expected to See Slower Growth in 2019

Trucking industry economists say – after a 2018 that saw record-setting levels of freight-hauling demand and driver pay as tonnage levels reached a 20-year high – the industry is expected to remain strong in 2019 but undergo a bit of a cool-down.

Source →Shippers, not just US truckers, own driver shortage

For years, shippers were warned about the looming driver shortage. Trucking executives sometimes were accused of “crying wolf” when it came to driver shortages to secure rate increases – until 2018. Suddenly, the wolf was real and had teeth, in the form of higher spot and contract rates and rejected freight tenders that drove double-digit cost increases.

Source →U.S.-China trade war takes toll on global manufacturing

Factory activity weakened across much of Europe and Asia in December as the U.S.-China trade war and a slowdown in demand hit production in many economies, offering little reason for optimism as the new year begins.

Source →US economy, markets: What to expect in 2019

While 2018 was largely characterized as a strengthening U.S. economy – equities are ending the year on a tumultuous note, causing concern among investors for the coming year.

Source →U.S. manufacturers expand at slowest pace in 15 months as business confidence wanes, IHS Markit finds

A survey of American manufacturers showed the slowest growth in December in 15 months, reflecting a dip in confidence among executives about how their businesses will perform in the new year. IHS Markit said its manufacturing PMI slipped to 53.8 in December from an initial reading of 53.9, and it was down from 55.3 in the prior month.

Source →Oil Begins 2019 With Renewed Slide Amid Fears Over China Growth

Oil started 2019 with another price slide as weaker Chinese manufacturing data pointed to slowing demand in the world’s second-biggest consumer of the fuel and to growing risks of a global crude surplus.

Source →Average Price of Diesel Drops 2.9¢ to $3.048 a Gallon

The U.S. average retail price of diesel dropped 2.9 cents to $3.048 a gallon, the U.S. Energy Information Administration reported, as crude oil prices hovered around $45 per barrel.

Source →Detention-demurrage fees hit LA-LB port shippers

Shippers’ frustration with their inability to pick up containers and return empties at the Los Angeles-Long Beach port complex is rising, as thousands of dollars’ worth of detention and demurrage charges are accumulating owing to an unusual period of congestion.

Source →Tariff war takes its toll in November as air cargo volumes decline

Air cargo volumes for November bucked normal seasonal trends and declined compared with October levels. The latest figures from analyst WorldACD show that there was a 1.4% year-on-year (YoY) decline in cargo volumes in November, but more surprisingly there was a slip of 2% compared with October. Usually air cargo demand increases in November as the industry enters its peak season.

Source →Rail Traffic for the Week Ending December 22, 2018

The Association of American Railroads (AAR) today reported U.S. rail traffic for the week ending December 22, 2018. For this week, total U.S. weekly rail traffic was 567,252 carloads and intermodal units, up 4.2 percent compared with the same week last year. Total carloads for the week ending December 22 were 277,111 carloads, up 3.1 percent compared with the same week in 2017, while U.S. weekly intermodal volume was 290,141 containers and trailers, up 5.3 percent compared to 2017.

Source →8 Trends to Watch in Trucking in 2019

Looking back, looking forward. It’s what we do here at the end of the year, an artificial boundary in time. Reporting on the trucking industry was eventful in 2018, and it looks to get even more exciting in 2019. Here are nine areas I believe we’ll be keeping a close eye on in the new year.

Source →Not Everyone’s Happy with FMCSA’s Preemption of California Break Rules

The Federal Motor Carrier Safety Administration’s pre-holiday granting of petitions to preempt California’s meal and rest break rules for truck drivers, which differ from current federal hours-of-service regulations, is being met with either cheers or jeers from a range of trucking stakeholders.

Source →China cuts tariffs on more than 700 goods in bid to open up economy and lower domestic consumer costs

China will lower import taxes on more than 700 goods from January 1 in another round of tariff cuts as part of its efforts to open up the economy and lower costs for domestic consumers. There will also be cuts to some export tariffs, and temporary import tariff rates will be as low as zero for some goods, the Ministry of Finance said in a statement on Monday.

Source →U.S. Durable Goods Orders Up 0.8%, Led by Defense Spending

Orders to U.S. factories for long-lasting goods rose at a modest pace last month, but the gain was driven entirely by demand for military aircraft. Excluding transportation equipment, orders fell. Durable goods orders impact the trucking industry because trucks transport most of the goods once they are produced.

Source →U.S. holiday shopping season best in six years: report

Sales during the U.S. holiday shopping season rose 5.1 percent to over $850 billion in 2018, the strongest in the past six years, according to a Mastercard report, as shoppers were encouraged by a robust economy and early discounts.

Source →2018 Diesel Prices Stay Consistent Around $3 a Gallon

Diesel powers trucking, and as diesel prices fluctuate they can provide boons or headaches for the industry. In 2018, a variety of factors pushed the price of trucking’s main fuel up and down, including capacity crunches, severe weather catastrophes and geopolitical events.

Source →Peak season offers only modest air freight boost in November first look

Hopes last month for a rebound in peak season may have dimmed, as October’s decline in year-over-year air cargo traffic seems to have extended into November. Outliers to this trend include, again, Turkish Airlines, Air China, and China Southern Airlines. Most carriers and airports, however, do show continued positive year-to-date traffic compared to the same period in the year prior.

Source →What the government shutdown means for rail

The effects of the partial shutdown of the federal government on the rail community appear not to be significant, at least for now. The action comes as President Trump and the Republican-controlled Congress remain locked in a budget dispute over funding for a wall along the U.S. border with Mexico.

Source →Sectors Surge in Second Half

A deeper dive into trucking data showed a big year for the industry across three specific sectors, particularly after July. The numbers also portend glad tidings for 2019.

Source →DOT Preempts California Meal and Rest Break Rules, Citing Impact on Interstate Commerce

Trucking’s Hail Mary Pass to make federal hours-of-service laws fully the law of the land, both theoretically and practically, has been successfully completed. The Federal Motor Carrier Safety Administration announced on Dec. 21 that it is granting petitions to preempt the State of California’s meal and rest break rules for truck drivers, which differ from current federal hours-of-service regulations.

Source →Top 10 Trucking News Stories of the Year

2018 was a year of new technologies and new regulations for the trucking industry and our 10 most popular news stories of the year covered the gamut. From potential hours of service changes to the legalization of marijuana to global trade deals, we covered it all to keep our readers informed throughout the year.

Source →Freight Transportation Profits, Prospers

Without a doubt, 2018 was a banner year for trucking and almost every other form of freight transportation. Spurred in part by a cut in corporate taxes, business investment took off, hiring picked up and freight volume soared with both domestic and international shipments sharing in the bounty.

Source →Homebuilder Sentiment Tumbles to Weakest in Three Years

Sentiment among U.S. homebuilders fell in December to the lowest level since 2015, missing all forecasts and signaling that the industry’s struggles are intensifying amid elevated prices and higher borrowing costs.

Source →Average price per gallon of diesel down for ninth consecutive week, EIA reports

The Department of Energy’s Energy Information Administration (EIA) reported this week that the national average price per gallon for diesel gasoline dropped for the ninth straight week for the weekending December 17.

Source →